The U.S.-China Trade War: A High-Stakes Economic Showdown

The escalating trade tensions between the United States and China have reshaped global economic relations, creating ripple effects across industries, supply chains, and diplomatic alliances. What began as a dispute over tariffs has evolved into a multifaceted economic and geopolitical struggle, with both nations deploying an arsenal of trade weapons—from export controls to currency maneuvers—while the world braces for the fallout.

Tariffs and Retaliation: The Opening Salvo

The Trump administration’s 2018 tariffs on Chinese goods, justified by allegations of intellectual property theft and unfair trade practices, marked the first major escalation. Targeting over $250 billion in imports, the U.S. aimed to force concessions, but Beijing responded with its own tariffs—10% to 15% on $20 billion of American products, including soybeans and automobiles. This tit-for-tat strategy quickly spiraled, with China later imposing punitive duties as high as *125%* on U.S. goods, a move one Chinese official dryly called “a joke”—a clear signal that neither side would blink easily.

The collateral damage? U.S. farmers faced plummeting soybean exports, while Chinese manufacturers scrambled to reroute supply chains. Meanwhile, global markets shuddered at the volatility, with the IMF warning of a *$700 billion* hit to worldwide GDP by 2020.

Beyond Tariffs: China’s Regulatory and Financial Counterpunches

China didn’t stop at tariffs. It weaponized *rare earth exports*—critical minerals used in semiconductors, electric vehicles, and defense tech—threatening to strangle U.S. tech and military supply chains. By tightening export controls, Beijing exposed America’s reliance on Chinese materials, a vulnerability Washington is still scrambling to address.

Then came the *yuan devaluation*. By letting its currency weaken, China effectively discounted its exports, countering U.S. tariffs’ price hikes. This monetary jiu-jitsu not only cushioned Chinese exporters but also made U.S. goods pricier in China, squeezing American businesses further. Meanwhile, Beijing blacklisted U.S. firms like Apple and Tesla from government contracts, turning market access into a political bargaining chip.

Diplomatic Chess and the Global Domino Effect

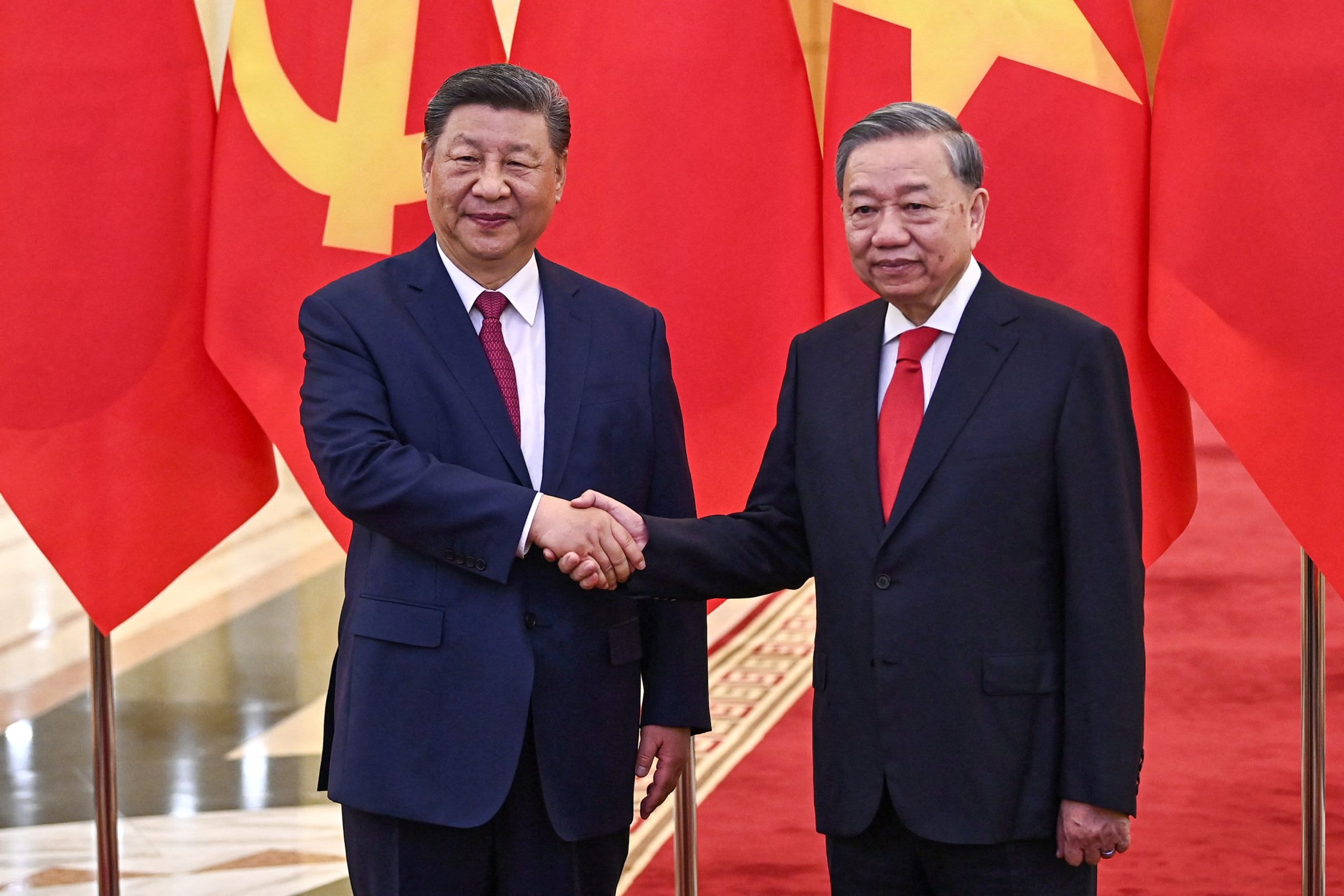

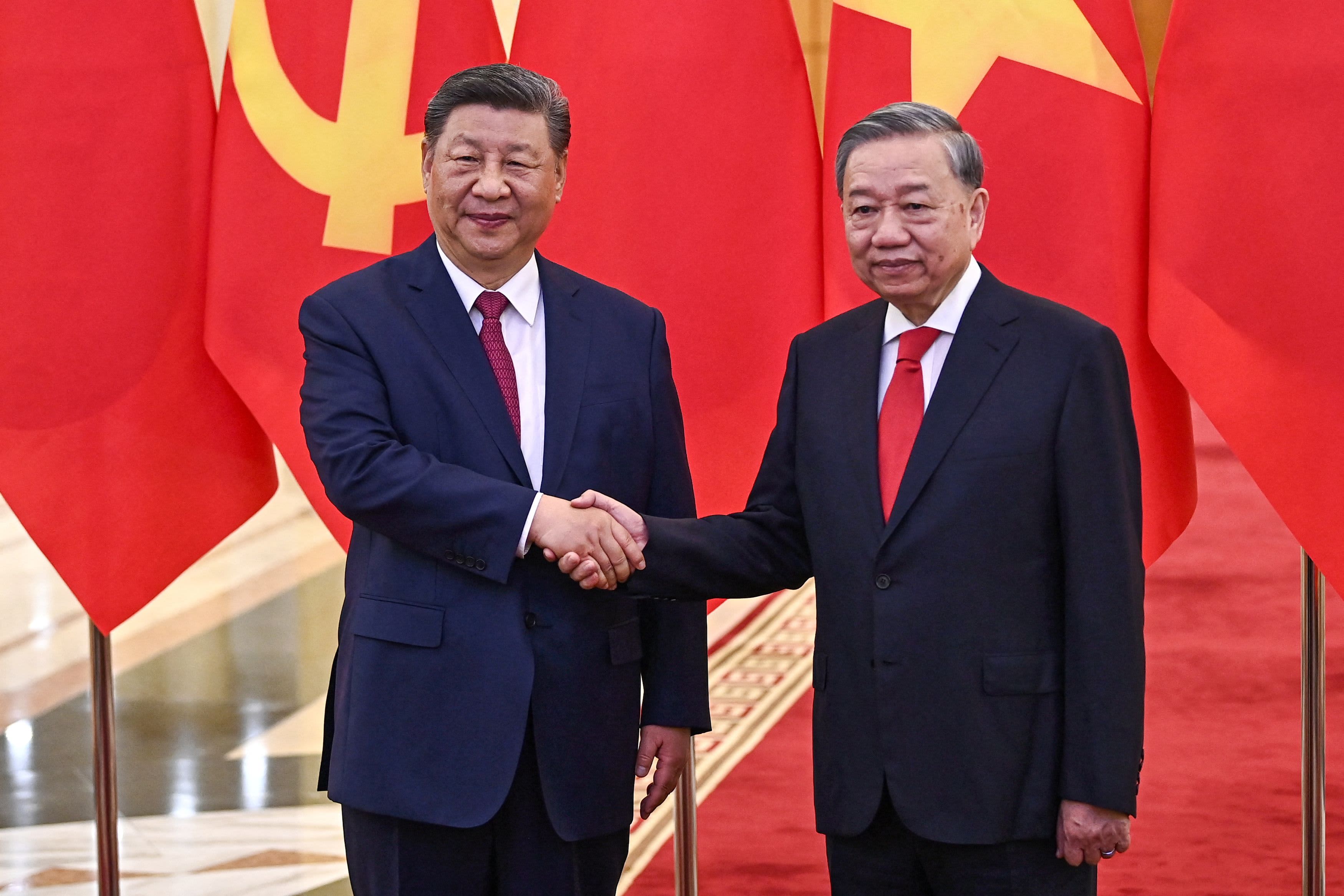

The trade war spilled into diplomacy. President Xi Jinping courted allies in Europe, Africa, and Southeast Asia, framing the U.S. as a bully and pitching China as a stable trade partner. His message: aligning with Washington’s trade isolation would be “selfish and shortsighted.” The strategy paid off—China deepened ties with the EU via the 2020 investment deal and expanded its Belt and Road footprint, while the U.S. struggled to rally a unified front.

Globally, the chaos disrupted supply chains, from Vietnamese factories overwhelmed by redirected orders to German automakers caught in the crossfire. The WTO estimated global trade growth slowed to *1.2%* in 2019, the weakest since the 2008 crisis. Stock markets swung on every tweet, and CEOs lamented the impossibility of long-term planning.

Where Do We Go From Here?

The Biden administration has dialed back some tariffs (notably on consumer electronics) to ease inflation pressures, but core issues—intellectual property, market access, and tech supremacy—remain unresolved. China demands tariff rollbacks as a precondition for talks; the U.S. insists on structural reforms.

The lesson? Unilateral trade wars are messy, costly, and rarely decisive. With both economies now entangled in a broader tech cold war—see Huawei bans and semiconductor sanctions—the path to détente is murky. Yet interdependence lingers: the U.S. still buys Chinese goods, and China needs American innovation. The world watches, hoping for a truce before the next bubble bursts. *Pop.* Maybe then we’ll finally see those tariff-free sneakers go on clearance.